What is Double Entry System

In Accounting, Double entry system is a method of book keeping that entering the values into the books. According to the double entry accounting principle, every transaction of business must be recorded in two sides i.e. debit side and credit side. Every business transaction involves two sides, one side with debit and another side with credit. The amounts have to be equal on both debit and credit sides.

The double entry system can be easily understand by an equation of accounting.

- Assets = Liabilities + Capital

- Capital = Assets – Liabilities

- Assets – Liabilities = Capital (Owner’s Equity)

- Net Assets = Owner’s Equity.

Examples

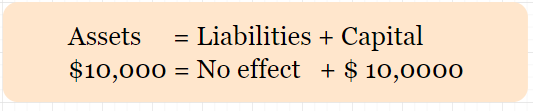

- Tutorial Kart started a business a cash of $ 10,000.

In this business transaction, one side asset (cash) is coming into business and in another side capital is being brought by Tutorial Kart.

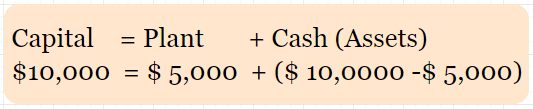

In next transaction, Tutorial Kart purchased plant in cash for $ 5,000.

In this example, the plant is purchased with cash $ 5,000 from the total capital value of $ 10, 000. Now remaining total cash available with Tutorial Kart is $ 5,000 (Cash = Capital – Plant).

Rules of Double Entry System

In Double entry accounting system, the business transactions are records in both sides. Each transaction will have two aspects, i.e. if the company purchased plant, in return it should give back with the same value.

While recording the transactions, each transaction of total debit should be equal total credit. The accounting terms Debit and Credit indicates, where the transaction should be recorded on the left side or right side. The debit and credit rules as per accounts types are

| Real A/c | Personal A/c | Nominal A/c | |

| Debit | What comes in | The receiver | Expenses & losses |

| Credit | What goes out | The giver | Incomes & gains |

Advantages of double entry system

- Through double entry system, company gets exact and reliable records all business transactions

- All the information of company accounts including assets & liabilities, income & expenses available

- Helps in preparation of financial statements including balance sheets, profit & loss A/c.

- Avoid error and duplication of transaction.