What is Journal

Journal is also called as “Day Book” or “Primary Book” or First entry Book”. Journal entry is a first step procure in accounting. Originally the word Journal is derived from a Latin language word “journ” which means a day.

All the day to day business transaction of firm are record chronologically in Journal entry book. The journal entries are balanced with the sum of debit side amount and credit side amount.

Debit Side Amount = Credit Side Amount

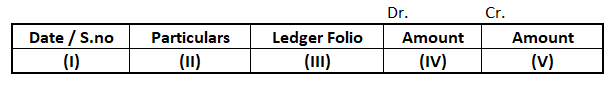

Proforma of a Journal

- Date/ S.No: The first column of Journal is date or serial number. It is updated with the transaction record date or its serial number.

- Particulars: The second column of Journal is particulars, updated with the particulars of business transactions that related accounts types with description.

- Ledger Folio: The third column of Journal is Ledger Folio number where the journal entry is posted.

- Amount (Dr.) : The fourth column of Journal is used to update the debit amount of transaction.

- Amount (Cr.): The fifth column of Journal is used to update the credit amount of transaction.

Journal Types

A business firm can maintain different types of journals as per business requirements. The different types of journals are

- Cash receipt journal

- Cash disbursement journal

- Sales journal

- Purchases journal

- General journal

- Special journal

How to prepare Journal Entries in Accounting

The preparation of journal entries (Journalizing) are very simple method which are as follows –

- First read and understand the transaction clearly. Find out which account is to be debited and credited, and after this you can enter journal entry.

- After entering the journal entry, write down the summary description (narration) for both debit and credit transactions.

Rules of Journalizing

Below are the equation accounting approach which accounting follows to record the transactions.

| Assets | Increase in Assets | Debit (Dr.) |

| Decrease in Assets | Credit (Cr.) | |

| Capital | Increase in Capital | Credit (Cr.) |

| Decrease in Capital | Debit (Dr.) | |

| Liabilities | Increase in Liabilities | Credit (Cr.) |

| Decrease in Liabilities | Debit (Dr.) | |

| Revenue | Increase in Revenue | Credit (Cr.) |

| Decrease in Revenue | Debit (Dr.) | |

| Expenses | Increase in Expenses | Debit (Dr.) |

| Decrease in Expenses | Credit (Cr.) |

Example of Journal Entries

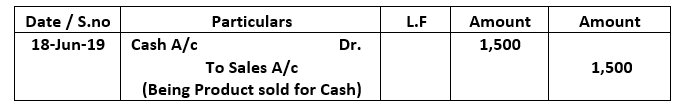

A firm sold its product at $1500 and received full amount in SAP.

>> The entries of journal entries are as follows.

In above example –

- Firm sold a product for full amount $1, 500 and received amount and it leads to increase of cash balance of the firm.

- Increase of cash (asset) should be posted in debit side i.e. Increase in asset > Debit

- Sales of product is to be posted to sales a/c, represents increases in sales.