Accounting Equation

Accounting equation is a basic equation (Assets = Liabilities +Equation) and foundation for double entry system. Before creation of financial statements like Balance Sheet, Profit & Loss accounts, you need to understand the basic fundamental concept of accounting i.e accounting equation. Basically an accounting is based on the following equation

Assets = Liabilities + Owner’s Equity

or

Assets = Liabilities + Capital

The above accounting equation also can be written as

- Equity = Assets – Liabilities

- Liabilities = Assets – Equity

The accounting equation represents the Assets of company is equal to liabilities and owner equity.

- Assets: Assets means what business owns

- Liabilities: Liabilities means what business owes from others. Liabilities are debits to the company

- Owners Equity: Owner equity refer to capital that company ownership contributed the money to the business.

Accounting equation is a basic foundation for double entry system and the equation to be followed when recording journal entries. At any point of time or after each transaction is recorded, the accounting equation must hold true, i.e two sides of accounting equation must be equal with values (debit and credit values to be equal).

Before understanding of which account to be debited and which account to be credited, please refer golden rules of accounting.

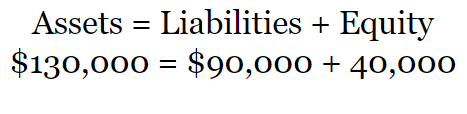

Example 1:

- A firm initial investment amount is $130,000

- $90,000 of which is loaned from the bank

- $40,000 of which is contributed by the owner

Example 2:

- To start a business, you need $1500 but you have only $1000.

- You need remaining amount $500 and you got loan from bank

- Now you have total amount $1500 ($1000 + $500) to start your new business

- You purchased goods of value $400.

Now total left assets value: $1100 (Cash Asset) + $400(Inventory Asset) = $1000 (Owner’s Capital)+ $500 (Bank Loan).

Example 3:

- Purchased machinery that costs $50,000

- Paid in cash $20,000

- Paid remaining amount 30,000 through bank loan

The above example can be recorded as:

| Particulars | Debit | Credit |

| Machinery | 30000 | |

| Cash | 20,000 | |

| Bank Loan – Machinery | 10,000 |

In above example, both machinery and cash are assets accounts and bank loan is a liability account. By applying an accounting equation, Liabilities = Assets – Equity, the total liabilities value is $10,000 (30,000 – 20,000).