How to define accounts for cash discount taken in SAP

In this SAP FICO tutorial you will learn how to define accounts for cash discount taken in SAP step by step using transaction code OBXV.

Purpose of configuration

Through this SAP configuration you define the G/L account numbers for your cash discount received accounts. The SAP system posts the cash discount amount to this G/L account when you are clearing the open items. Discounts are to be adjusted to purchases where a cash discounts are to shown under other income.

Perquisite before assigning G/L accounts to cash discount

Assign chart of accounts to company code

Create G/L accounts for cash discounts using transaction code FS00

| G/L Account | Account Group | Description |

| 300101 | Other Income | Cash discount received |

Configuration steps

| SAP R/3 Role Menu | Define accounts for cash discount taken |

| Transaction Code | OBXV |

| IMG Menu Path | SPRO > SAP Reference IMG > Financial Accounting (New) > Accounts Receivable and Accounts Payable > Business transactions > Outgoing payments > Outgoing payment global settings > Define accounts for cash discount taken |

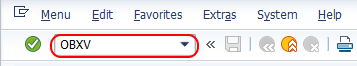

Step 1 : – Enter SAP T-code “OBXV” in the commend field and press enter to continue.

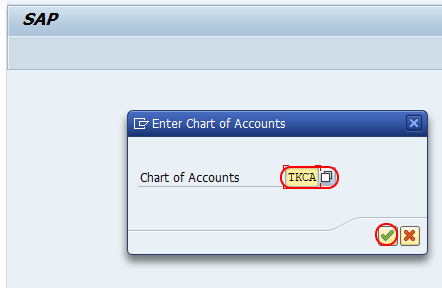

A window opens for entering the chart of accounts key, update the chart of account (COA) and press enter.

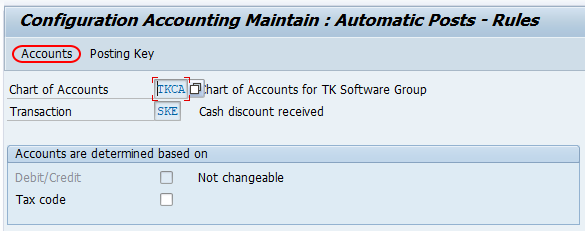

Step 2 : – On configuration accounting maintain: accounting posts -rules, click on accounts key for assignment of G/L accounts for cash discounts.

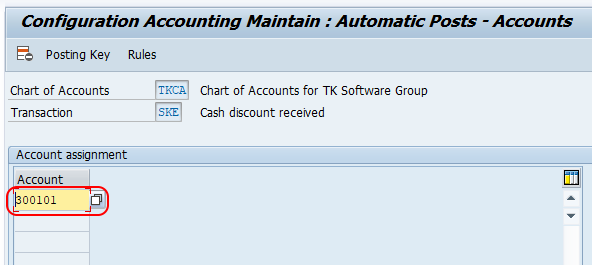

Step 3: – Under Account assignment option, update the cash discount received G/L in the field account as shown below image.

After assignment of general ledger cash discount received accounts, click on save button and save the configured details.

Successfully we have defined accounts for cash discounts taken in SAP Financial Accounting.