In this SAP tutorials, you will learn how to define tax procedure in SAP systems. In our previous training tutorial we have discussed about what is sales tax and purchase tax in SAP.

How to Define tax procedure in SAP

You can maintain tax calculation procedures in SAP by following one of the navigation method.

- Transaction code: – OBYZ

- Menu Path: – SPRO –> IMG –> Financial Accounting (New) –> Financial Accounting Global Settings (New) –> Tax on sales/purchases –> Basic settings –> Check calculation procedure.

Step 1) Enter transaction code “OBYZ” in the SAP command field and enter.

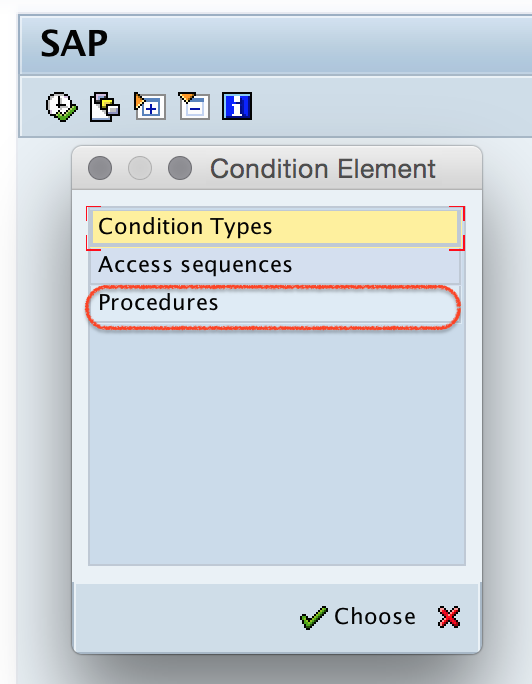

Step 2) A pop up window condition element screen displays with options, you need to choose procedures so double click on it.

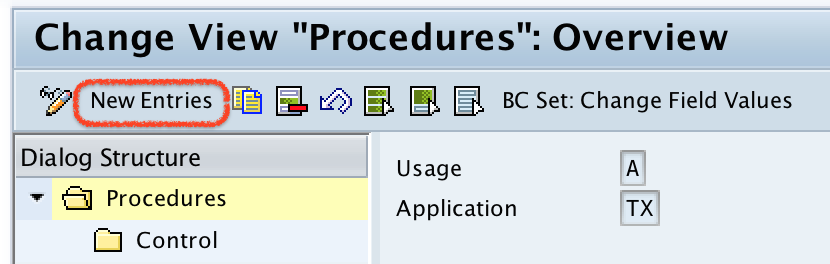

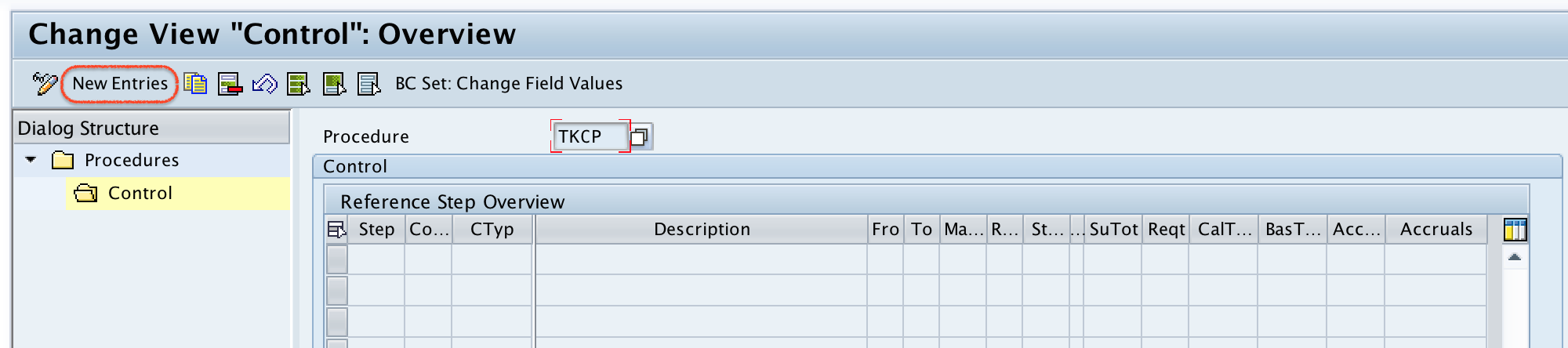

Step 3) On change view procedure screen, click on new entries button for definition of new tax procedure in SAP.

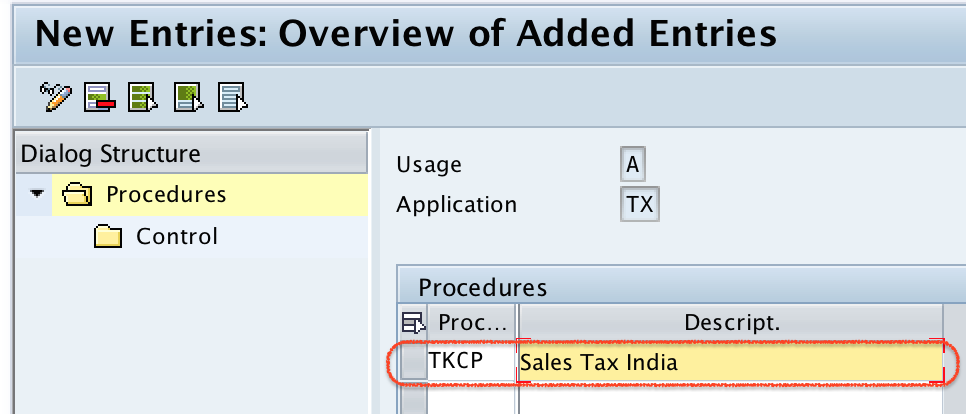

Step 4) On new entries calculation procedures screen, update the following details.

- Procedures: – Enter the four digits key that identifies the tax procedure in SAP.

- Description: – Update the descriptive text of tax calculation procedure – Sales tax India.

After maintaining the details, click on save button and save in your request number.

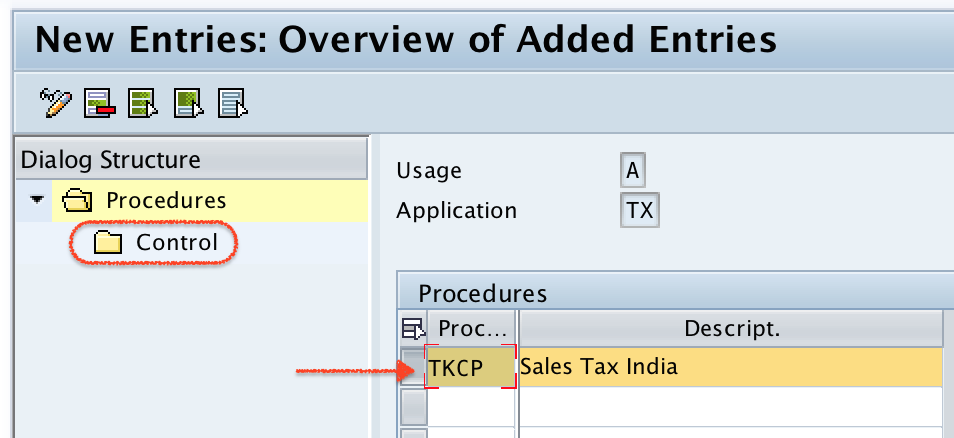

Step 5) Now select TKCP procedures row and double click on control data folder.

Step 6) Select new entries button.

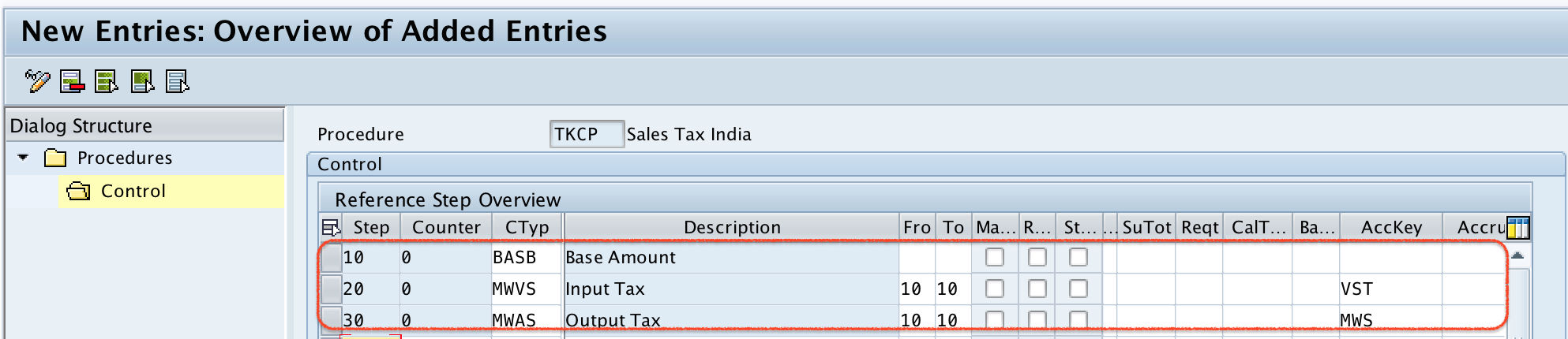

Step 7) On new entries screen, update the following details.

- Step: – Enter the number (10, 20, 30…) which specifies the sequence of the conditions within a procedure

- Condition type: – Update the condition type key that indicates the each activity or tax.

- Description: – Description text will be automatically updated based on condition type text.

- From, To: – This indicate which tax should be calculated on which base amount.

- Account key: – Assign the account that respective to condition types.

| Step | CType | Description | Fro | To | AccKey |

| 10 | BASB | Base Amount | |||

| 20 | MWVS | Input Tax | 10 | 10 | VST – Input Tax |

| 30 | MWAS | Output Tax | 10 | 10 | MWS – Output Tax |

After maintaining all the required details, click on save button and save the configured details.

Successfully we have maintained tax calculation procedures in SAP.